Let’s discuss the problem first:

Before understanding how data analytics help the banking sector let us have a glimpse of this sector. As we all know the primary business of any bank is to collect money from their customers in their savings account and then give loans to other needy customers and charge interest from them. These interests charged by the bank are the main source of income.

But now the question arises, What if, anyone fails to repay the loan? In this case, it becomes a bad debt for the bank which is considered a failure or a bad transaction that affects the bank’s reputation as well as business. If we look at the past, there have been many cases India and Abroad where banks had to face many losses. These losses were in thousands and lakhs of crores and also some banks were shut down because of these bad debts and losses.

Here comes the solution of data analytics:

Now we come to the part of how these banks can solve this kind of problem. We are a country of 1.4 billion citizens and banks are an essential part of the economy which caters to this population and their loan requirements. But at the same time, banks also have to focus on loan repayments and their business to grow and stay in the market.

Now let’s discuss how exactly data analytics helps the bank to judge who can be the ideal candidate to offer a loan and whether he/she is a potential candidate to repay the loan on time or not. Whenever you apply for a loan in a bank. Bank employee collects a huge amount of data from you, including your address, your PAN, your account details, your salary slip, your assets, the number of family members depending on you, your family member’s occupation, and the list goes on and on.

Now, what do you think, a bank does with all this data?

The answer is that the bank starts analyzing your data on different parameters. Now, we are going to discuss a Few of the analytics:

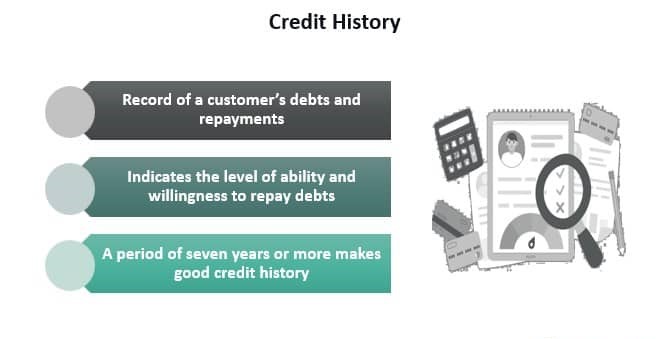

- Credit History: There is a guideline by RBI, that every individual has to link their PAN card with all their bank accounts. This step helps the government to track the transactions of every individual. After performing data analytics on that data, credit history is prepared.

The banks check the credit history of any individual to analyze what is your past behavior to repay loans(if any). A clean credit history indicates your responsibility to repay the loan on time and also makes you an eligible candidate to offer a loan.

2. Credit Score: To understand the concept of credit history, RBI created the concept of credit score to make things easy to understand for common people. Credit Score is nothing but the numerical representation of the complete credit history of an individual.

Many credit bureaus in India keeps providing credit score to every individual in India like CIBIL, EQUIFAX, EXPERION, and CRIF HIGH MARK. The most famous credit score bureau in India is CIBIL which categorizes every individual in the range of 300-900.

To read about the other credit score bureaus, visit this link

3. Income and Employment Stability: The next parameter to be analyzed by the bank is your income and employment stability. Income is a very important parameter to analyze for any bank before giving you a loan because it helps the banks to analyze how much loan can be given and what should be the EMI for the loan so that the individual can handle both(personal expenses and EMI).

Employment stability is the second phase of this analysis. The data analytics of employment stability refers to the mode of job an individual is involved in, how that industry is performing(growing, saturated, or declining), how much secured, an employee’s life and salary are in that industry, etc. It becomes an add-on to the individual side for loan eligibility.

Lenders also prefer consistency in their employment history and a steady income stream. Frequent job changes can disrupt your income flow, affecting your eligibility for a loan. As a result, obtaining a loan is generally easier for salaried individuals than those who are self-employed.

To read more, click on the link

4. Debt-to-Income Ratio: This data analytics is done when any individual has already an ongoing loan. This analysis is important and done to check if after paying the EMI of the last debt, there must be a sufficient amount of income left to pay the EMI of the next loan as well as for personal expenses. The lower debt-to-income ratio refers to healthy financials and increases the chances of loan approvals.

5. Loan Amount and Purpose: This is an important factor to consider because, on behalf of loan amount and purpose, the bank has designed different loan products for different purposes to cater to every possible requirement of every individual. Nowadays, banks offer loans for cars, bikes, education, homes, personal, and so on.

The government always keeps focusing more and more on promoting the financial conditions of farmers that’s why all the banks follow the guidelines of RBI and provide loans to farmers on behalf of their crops, lands, cattle, etc.

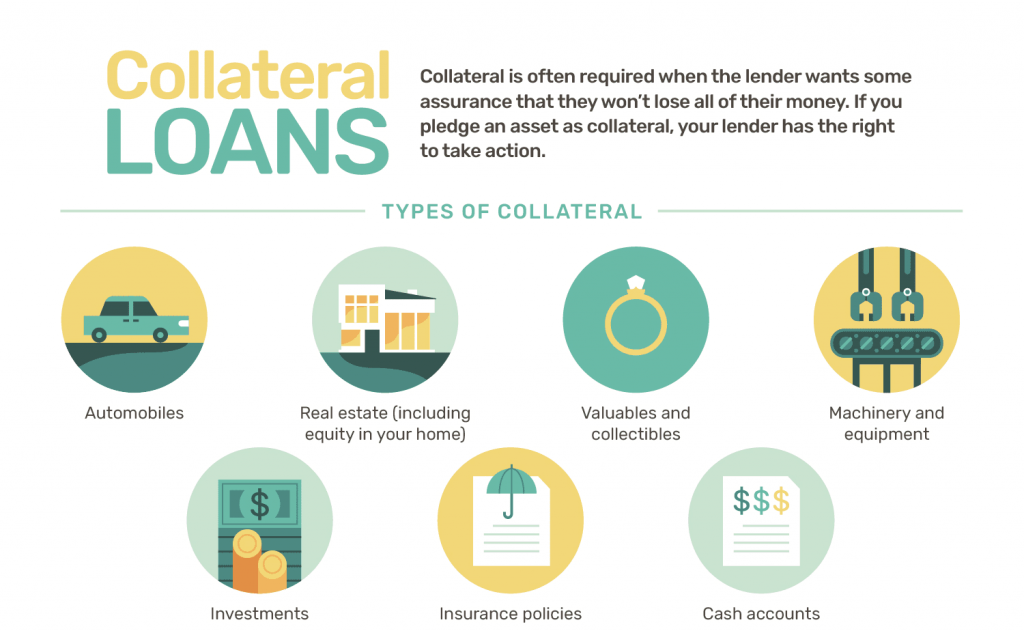

6. Collateral: It is a factor that makes the banks a little bit relaxed, so what is it? A collateral means an individual who has applied for a loan is using a high-value property( of any kind like gold, house, land, etc. ) as a mortgage to the bank. The reason banks feel a bit relaxed is because if in any unwanted scenario, the individual fails to repay the loan, the bank has also another way to recover the loan. The banks take the help of data analytics to understand the value of the collateral and how much loan can be offered against the collateral.

Usually, the banks do not want these kind of circumstances but if this happens the banks seize the property, auctions the property, and recover its amount. But now the question is, does it help the individual? The answer is YES! Mortgaging a property helps the individual in the long duration of the loan and less valued EMI.

If you are willing to learn more about data analytics in the banking sector, follow this link and register yourself for the free workshop on data analytics and data science with Console Flare.

What’s in it for you!

All these steps of the loan application, data analytics, and decision-making need expertise in the field of data science. The banks hire these(data analysts & data scientists) experts regularly, for which they are ready to offer 10 lakhs to 25 lakhs per annum.

To learn more about data analysts’ salary packages in the banking sector, click here

Apart from these loan processes banks also hire data analysts for risk assessment, fraud detection, recommendation systems, customer segementation, performance analysis, operational efficiency, regulations & compliance analysis, cost optimization, predictive modeling, market trends analysis and so on.

Willing to create or shift your career in data analytics?

Click here to get your first class free from Consoleflare (The company with the USP of training data analytics in hindi with the track record of helping freshers and Non-IT professionals in creating their career in data science).